Inflation Relief Measures Announced

The Workers’ Party (WP) has expressed partial approval of the Singapore Government’s S$1.5 billion support package aimed at assisting vulnerable citizens in coping with inflation. While calling the initiative a “step in the right direction,” WP remains firm in opposing the impending increase in Goods & Services Tax (GST), which is set to rise incrementally to 9 per cent by 2024.

Government Justifications and Opposition Concerns

Deputy Prime Minister and Finance Minister Lawrence Wong justified the planned GST hike, citing escalating healthcare expenses driven by an ageing population. Despite introducing increased taxes on luxury goods, property, and high-income earners, Mr Wong noted these measures alone fall short of meeting the nation’s revenue needs.

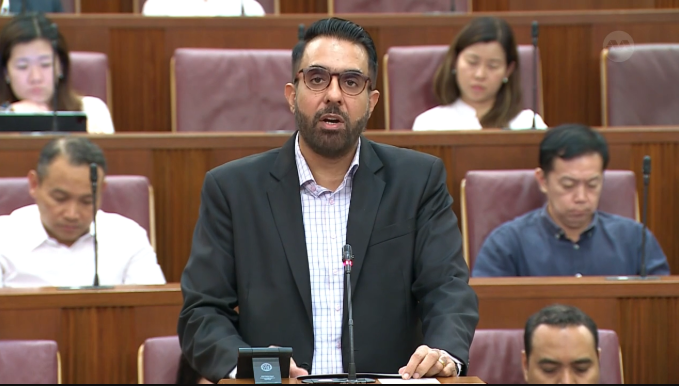

In contrast, WP argues for alternative revenue options, including wealth taxes and adjustments to reserves contribution limits, as outlined in a Facebook statement on 22 June. WP Leader of the Opposition, Pritam Singh, highlighted these proposals during the recent Budget debate, describing the GST hike as ill-timed given rising inflation and high living costs.

Impact of Inflation on Citizens

The WP underscored how inflation has reached its highest level in a decade, placing significant strain on Singaporeans. “This is not the time to increase GST,” stated WP representatives, reaffirming their commitment to advocating for alternative policies in Parliament.

Relief Measures Breakdown

The support package leverages surplus funds from 2021’s better-than-expected fiscal outcomes, avoiding reliance on past reserves. Key measures include:

An additional GST Voucher cash payment of up to S$300 for 1.5 million eligible citizens.

S$100 in utilities credit for every Singaporean household to mitigate rising energy costs.

Looking Ahead

Mr Wong emphasised the importance of maintaining a strong fiscal position to address longer-term challenges such as climate change and evolving healthcare demands. While WP acknowledged these concerns, they remain steadfast in their belief that more equitable tax solutions should be prioritised over the GST hike.

The debate continues as Parliament seeks to balance immediate inflation relief with sustainable economic strategies.