Authorities Arrest 13 Suspects Linked to Cross-Border Money Laundering

Transnational Scam Syndicates Dismantled

Thirteen individuals suspected of participating in two transnational scam syndicates were arrested during a collaborative operation by the Singapore Police Force (SPF) and the Royal Malaysia Police (RMP). These syndicates were involved in extensive money laundering activities, which have now been dismantled, according to an SPF news release on 16 August.

Coordinated Raids in Malaysia and Singapore

The arrests followed coordinated raids. Nine suspects were apprehended in Malaysia by officers from the SPF’s Commercial Affairs Department and the RMP’s Commercial Crime Investigation Department, while the remaining four were arrested in Singapore by the Commercial Affairs Department.

Since July, both police forces have been sharing critical information from scam case investigations. Joint efforts revealed the syndicates’ operations were based in Kuala Lumpur and Johor.

Victims Scammed Out of Over S$1.3 Million

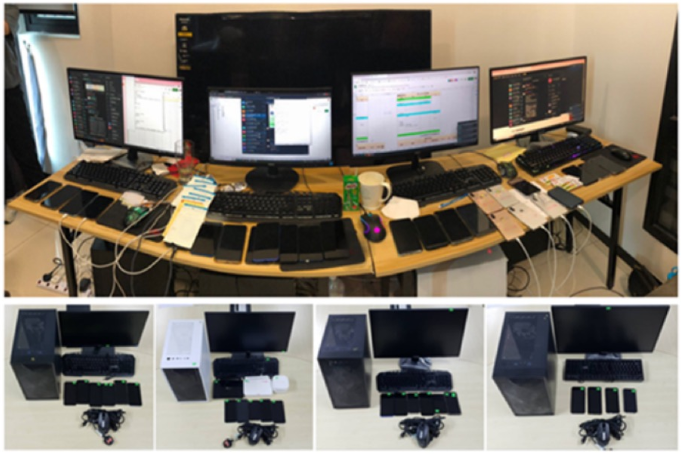

On 10 August, simultaneous raids at two apartment complexes in Kuala Lumpur and Johor led to the arrest of two Malaysian women and seven men, aged 19 to 39. These suspects are believed to be linked to scams that defrauded over 60 victims across Singapore, involving investment scams, job scams, fake gambling platforms, sextortion, impersonation scams, and loan scams. Total losses exceeded S$1.3 million.

Preliminary investigations revealed that the syndicates targeted victims in Singapore, Malaysia, Thailand, and Indonesia, laundering proceeds in Malaysia.

In Singapore, two men and two women, aged 18 to 49, were arrested for allegedly assisting the syndicates by providing access to their bank or Singpass accounts. Another 24 individuals are assisting in ongoing investigations.

Warnings Against Abuse of Singpass and Banking Accounts

David Chew, director of the Commercial Affairs Department, cautioned the public against job offers requiring the misuse of Singpass or bank accounts, emphasising the legal consequences.

“Cyber-enabled scams remain a serious concern. Criminals exploit the Internet to deceive victims and recruit money launderers with promises of easy money,” he said.

Chew reaffirmed that firm action will be taken against those who aid syndicates, whether by selling account details or laundering illicit funds.

Legal Consequences

Under Singapore’s Computer Misuse Act, facilitating unauthorised access to computer material can lead to imprisonment of up to two years, a fine, or both. Disclosing access codes for wrongful purposes carries penalties of up to three years in prison, a fine, or both.

Chew also expressed gratitude to the RMP for their strong collaboration in combating cross-border crime syndicates.